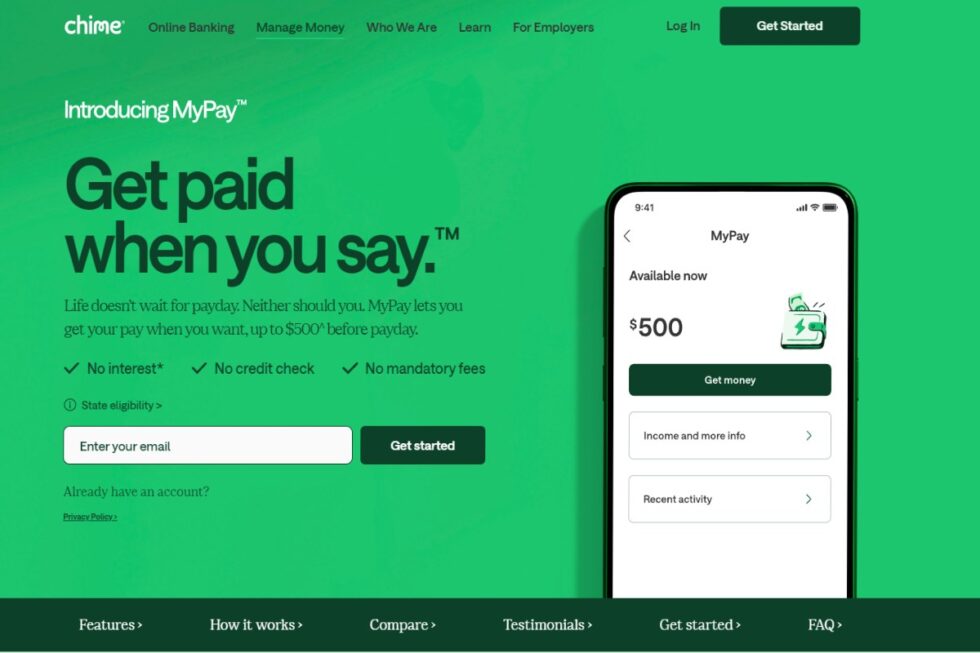

Chime—an online financial services company that has transformed how people access their money, particularly through its unique “Chime my pay” feature, which allows early access to paychecks. This article will explore what Chime’s “Chime my pay” feature is, how it works, and how it has become a game-changer for millions of users.

What is Chime my pay?

Chime is one of offerings, a cash advance targeting existing users with direct deposit to their Chime checking account. It’s high — up to 50% of your expected pay, with a maximum of $500 — but the $2 flat fee for fast funding is relatively inexpensive compared to most cash advance apps

Unlike most other cash advance apps, Chime doesn’t ask for a tip, and since the app doesn’t charge overdraft fees on its checking accounts, MyPay won’t set one off either.

Who Chime MyPay is best for

- Chime users who have received direct deposit into Chime checking account.

- Next payment is for those who have to make a small purchase and expect to receive money to repay the advance, as well as other needs.

- 10 of 10 credit consumers who wish to be provided within a particular day, or those who are willing to part with $2 to be amped up instantly.

- The people who do not always go over their means when making purchases.

Here is what you need for a Chime MyPay advance

To benefit from MyPay, you have to be a Chime checking account holder.

Similar to most other cash advances, the amount that the user is eligible for and advance at Chime depends on the income streams.

The company says that in order to decipher the pattern and amount of their check users it employs what it calls direct deposit history and other legit info.

Other data may also be shared by the users with unpredictable working schedules include the working location so that the app can cross-check working hours and the next paycheck expected.

To qualify for the MyPay Payroll card, the payroll card users must have deposited through Chime two or more direct deposit and each must be not less than $200.

- Firstly, many consumers are given $50 to $100 in advance, although a user’s credit limit can increase as soon as the next pay period.

- To those who frequently use MyPay, the history of direct deposit in the checking account, income and others define the limit enhancements.

- Some features that have been set to open a Chime checking account includes users must possess a Social Security number, email address, home address, remain at least 18 years old and a U.S citizen.

Advantages of Using Chime’s “Chime my pay”

- Financial Flexibility: Having your money as soon as possible helps you to meet such emergent needs as repair, medical bills, or even to have a nice weekend without using credit cards or payday loans.

- Peace of Mind: Early receipt of the paycheck can act as a good motivation by eradicating the stresses associated with financial planning. It eliminates the tough time when you have no money to pay for some bills, avoid overdraft fees and many more other.

- Fee-Free Banking: Another factor that has made Chime to become popular was the fact that it does not charge customers any fees. For instance, it does not have any maintenance fees, overdraft fees, or minimum balance requirements like most of the traditional banks.

- Simple Setup: Chime is very easy to use and the process of creating an account is fast and smooth. In essence, it is easy to create an account and getting direct deposit from your employer to get the most of “Chime my pay.”

How To Get An Advance With Chime My Pay: Step-By-Step Instructions

Below are the Chime my pay development processes that will enable Chime customers with an existing checking account of accessing an advance:

- If Chime my pay is offer in your state, you will find MyPay as an option at the top of the homepage of Chime’s app.

- You should look at the Chime my pay hub to check the amount of facilty you are allow to borrow.

- Next, you’ll select your advance amount by completing steps in the app.

- It will question if you want the greenbacks as soon as possible, within a week, within a month, or within three months.

- You can wait 24 hours to receive a no fees cash advance or you can wire for $2 to start up immediately.

- When you are okay with being provided with the advance, Chime will also disclose the amount of money you will remain expected to pay.

If you’re still indebted on your next direct deposit date, Chime subtracts the advance amount as well as the fast-funding fee if you chose to pay it.

Chime My Pay Reviews and Ratings

| Affortable | 4.0/4 |

| Structure | 2.5/4 |

| Transparency | 4.0/4 |

| Consumer Protection | 2.5/4 |

| Customer Experience | 4.0/4 |

| Advance amounts | $50 to $250. |

| Fees | Monthly subscription fee: $9.99 or $14.99.Optional fast-funding fee: $0.99 to $3.99. |

| Time to fund without express fee | 1 to 3 days |

| Time to fund with express fee | 20 Minutes |

| Overall Ratings | 4.3 |

FAQS

What is the check cashing limit of Chime MyPay?

Up to $500 of your expected wage for the coming pay period, 50%.

Which fees does Chime have for the MyPay service?

Fast-funding fee: $2.

How do you repay Chime MyPay?

Payed back with your next paycheck when it deposits to your chime checking account.

How long will it take to get a cash advance from Chime?

- Without paying an express fee: One day.

- With an express fee: Instantly.

Conclusion

Chime my pay is not just an addition to the features offered by Chime, for many it’s a lifeline to have more control and flexibility around their money. Chime further enables the clients to control their earnings by getting extra paychecks early enough and without the other spins of banking, it helps its users to plan for the future by meeting their bills head-on. And it is quite surprising that Chime is quickly rising as the go-to banking option on the Internet.